Blog Archives

The Finance Playbook for Scaling Complexity Without Chaos

From Controlled Growth to Operational Grace

Somewhere between Series A optimism and Series D pressure sits the very real challenge of scale. Not just growth for its own sake but growth with control, precision, and purpose. A well-run finance function becomes less about keeping the lights on and more about lighting the runway. I have seen it repeatedly. You can double ARR, but if your deal desk, revenue operations, or quote-to-cash processes are even slightly out of step, you are scaling chaos, not a company.

Finance does not scale with spreadsheets and heroics. It scales with clarity. With every dollar, every headcount, and every workflow needing to be justified in terms of scale, simplicity must be the goal. I recall sitting in a boardroom where the CEO proudly announced a doubling of the top line. But it came at the cost of three overlapping CPQ systems, elongated sales cycles, rogue discounting, and a pipeline no one trusted. We did not have a scale problem. We had a complexity problem disguised as growth.

OKRs Are Not Just for Product Teams

When finance is integrated into company OKRs, magic happens. We begin aligning incentives across sales, legal, product, and customer success teams. Suddenly, the sales operations team is not just counting bookings but shaping them. Deal desk isn’t just a speed bump before legal review, but a value architect. Our quote-to-cash process is no longer a ticketing system but a flywheel for margin expansion.

At a Series B company, their shift began by tying financial metrics directly to the revenue team’s OKRs. Quota retirement was not enough. They measured the booked gross margin. Customer acquisition cost. Implementation of velocity. The sales team was initially skeptical but soon began asking more insightful questions. Deals that initially appeared promising were flagged early. Others that seemed too complicated were simplified before they even reached RevOps. Revenue is often seen as art. But finance gives it rhythm.

Scaling Complexity Despite the Chaos

The truth is that chaos is not the enemy of scale. Chaos is the cost of momentum. Every startup that is truly growing at a pace inevitably creates complexity. Systems become tangled. Roles blur. Approvals drift. That is not failure. That is physics. What separates successful companies is not the absence of chaos but their ability to organize it.

I often compare this to managing a growing city. You do not stop new buildings from going up just because traffic worsens. You introduce traffic lights, zoning laws, and transit systems that support the growth. In finance, that means being ready to evolve processes as soon as growth introduces friction. It means designing modular systems where complexity is absorbed rather than resisted. You do not simplify the growth. You streamline the experience of growing. Read Scale by Geoffrey West. Much of my interest in complexity theory and architecture for scale comes from it. Also, look out for my book, which will be published in February 2026: Complexity and Scale: Managing Order from Chaos. This book aligns literature in complexity theory with the microeconomics of scaling vectors and enterprise architecture.

At a late-stage Series C company, the sales motion had shifted from land-and-expand to enterprise deals with multi-year terms and custom payment structures. The CPQ tool was unable to keep up. Rather than immediately overhauling the tool, they developed middleware logic that routed high-complexity deals through a streamlined approval process, while allowing low-risk deals to proceed unimpeded. The system scaled without slowing. Complexity still existed, but it no longer dictated pace.

Cash Discipline: The Ultimate Growth KPI

Cash is not just oxygen. It is alignment. When finance speaks early and often about burn efficiency, marginal unit economics, and working capital velocity, we move from gatekeepers to enablers. I often remind founders that the cost of sales is not just the commission plan. It’s in the way deals are structured. It’s in how fast a contract can be approved. It’s in how many hands a quote needs to pass through.

At one Series A professional services firm, they introduced a “Deal ROI Calculator” at the deal desk. It calculated not just price and term but implementation effort, support burden, and payback period. The result was staggering. Win rates remained stable, but average deal profitability increased by 17 percent. Sales teams began choosing deals differently. Finance was not saying no. It was saying, “Say yes, but smarter.”

Velocity is a Decision, Not a Circumstance

The best-run companies are not faster because they have fewer meetings. They are faster because decisions are closer to the data. Finance’s job is to put insight into the hands of those making the call. The goal is not to make perfect decisions. It is to make the best decision possible with the available data and revisit it quickly.

In one post-Series A firm, we embedded finance analysts inside revenue operations. It blurred the traditional lines but sped up decision-making. Discount approvals have been reduced from 48 hours to 12-24 hours. Pricing strategies became iterative. A finance analyst co-piloted the forecast and flagged gaps weeks earlier than our CRM did. It wasn’t about more control. It was about more confidence.

When Process Feels Like Progress

It is tempting to think that structure slows things down. However, the right QTC design can unlock margin, trust, and speed simultaneously. Imagine a deal desk that empowers sales to configure deals within prudent guardrails. Or a contract management workflow that automatically flags legal risks. These are not dreams. These are the functions we have implemented.

The companies that scale well are not perfect. But their finance teams understand that complexity compounds quietly. And so, we design our systems not to prevent chaos but to make good decisions routine. We don’t wait for the fire drill. We design out the fire.

Make Your Revenue Operations Your Secret Weapon

If your finance team still views sales operations as a reporting function, you are underutilizing a strategic lever. Revenue operations, when empowered, can close the gap between bookings and billings. They can forecast with precision. They can flag incentive misalignment. One of the best RevOps leaders I worked with used to say, “I don’t run reports. I run clarity.” That clarity was worth more than any point solution we bought.

In scaling environments, automation is not optional. But automation alone does not save a broken process. Finance must own the blueprint. Every system, from CRM to CPQ to ERP, must speak the same language. Data fragmentation is not just annoying. It is value-destructive.

What Should You Do Now?

Ask yourself: Does finance have visibility into every step of the revenue funnel? Do our QTC processes support strategic flexibility? Is our deal desk a source of friction or a source of enablement? Can our sales comp plan be audited and justified in a board meeting without flinching?

These are not theoretical. They are the difference between Series C confusion and Series D confidence.

Let’s Make This Personal

I have seen incredible operators get buried under process debt because they mistook motion for progress. I have seen lean finance teams punch above their weight because they anchored their operating model in OKRs, cash efficiency, and rapid decision cycles. I have also seen the opposite. A sales ops function sitting in the corner. A deal desk no one trusts. A QTC process where no one knows who owns what.

These are fixable. But only if finance decides to lead. Not just report.

So here is my invitation. If you are a CFO, a CRO, a GC, or a CEO reading this, take one day this quarter to walk your revenue path from lead to cash. Sit with the people who feel the friction. Map the handoffs. And then ask, is this how we scale with control? Do you have the right processes in place? Do you have the technology to activate the process and minimize the friction?

Operational Excellence: Drive Margin without Raising Prices

Finding Margin in the Middle: How to Drive Profit Without Price Hikes

In a market where inflation spooks buyers, competitors slash to gain share, and customers have more tools than ever to comparison-shop, raising prices is no longer the first, easiest, or even smartest lever to grow profit. Instead, margin must increasingly be found, not forced. And it must be found in the middle, which is generally found in the often-overlooked core of the operating model where process, precision, and practical finance intersect.

There is a reason why Warren Buffett often talks about companies with “pricing power.” He is right. But for most businesses, particularly in crowded or commoditized industries, pricing power is earned slowly and spent carefully. You cannot simply hike prices every quarter and expect customer loyalty or competitive positioning to stay intact. Eventually, elasticity catches up, and the top-line gains are eaten away by churn, discounting, or brand erosion.

So where does a wise CFO turn when pricing is off-limits?

They turn inward. They look beyond the sticker price and focus on margin mechanics. Margin mechanics refers to the intricate chain of operational, behavioral, and financial factors that, when optimized, deliver profitability gains without raising prices or compromising customer experience.

1. Customer and Product Segmentation

Not all revenue is created equal. Some customers consistently require more service, more concessions, or more overhead to maintain. Some products, while flashy, produce poor contribution margins due to complexity, customization, or low attach rates.

A margin-focused CFO builds a profitability heat map that resembles a matrix of customers, products, and channels, sorted not by revenue, but by gross margin and fully loaded cost to serve. Often, this surfaces surprising truths: the top-line star customer may be draining resources, while smaller customers yield quiet, repeatable profits.

Armed with this, finance leaders can:

- Encourage marketing and sales to prioritize “sweet spot” customers.

- Redirect promotions away from margin-dilutive SKUs.

- Discontinue or reprice long-tail products that erode EBITDA.

The magic is that no pricing change is needed. You’re optimizing mix, not increasing cost to the customer.

2. Revenue Operations Discipline

Most finance teams over-index on financial outcomes and under-index on how revenue is produced. Revenue is a function of lead quality, conversion rates, onboarding speed, renewal behavior, and account expansion.

Small inefficiencies compound. A two-week onboarding delay slows revenue recognition. A 5% lower renewal rate in one segment turns into millions in churn over time. A poorly targeted promotion draws in low-value users.

CFOs can work with revenue operations to improve:

- Sales velocity: Track sales cycle time and identify friction points.

- Sales productivity: Compare bookings per rep and subsequently adjust territory or quota strategies accordingly.

- Customer expansion paths: Analyze time-to-upgrade across cohorts and incentivize actions that accelerate it.

These are margin levers disguised as go-to-market metrics. Fixing them grows contribution margin without touching list prices.

3. Variable Cost Optimization

In many businesses, fixed costs are scrutinized with zeal, while variable costs sneak by unchallenged. But margin improvement often comes from managing the slope, not just the intercept.

Ask:

- Are your support costs scaling linearly with customer growth?

- Are third-party services like cloud, logistics, and payments growing faster than revenue?

- Are your service delivery models optimized for cost-to-serve by segment?

Consider the SaaS company that offers phone support to all users. By introducing tiered support, for example, live help for enterprises, self-serve for SMBs, it cuts the support cost per ticket by 30% and sees no drop in NPS. No price hike. Just better alignment between cost and value delivered.

There is an excellent YouTube video detailing how Zendesk transitioned to this model, which reduced costs, improved focus, and enabled smarter “land and expand” strategies for the GTM team.

4. Micro-Incentives and Behavioral Engineering

Margin lives in behavior. The way customers buy, the way employees discount, and the way usage unfolds are driven by incentives.

Take discounting. Sales reps often discount more than necessary, mainly out of fear of losing the deal or a reflexive habit of “close by any means possible”. Introduce approval workflows, better deal-scoring tools, and training on value-selling, and you will likely reduce unnecessary margin erosion.

Or consider customer behavior. A freemium product may cost more in support and infrastructure than it brings in downstream. By adjusting onboarding flows or nudging users into monetized tiers sooner, you reshape unit economics.

These are examples of behavioral engineering, which are minor design changes that improve how humans interact with your systems. The CFO can champion this by testing, measuring, and codifying what works. The cumulative effect on margin is real and repeatable.

5. Forecasting Cost-to-Serve with Precision

Finance teams often model revenue in detail but treat the cost of delivery as a fixed assumption. That is a mistake.

CFOs can partner with operations to build granular, dynamic models of cost-to-serve across customer segments, usage tiers, and service types. This enables:

- Proactive routing of low-margin segments to more efficient delivery models.

- Early warning on accounts that are becoming margin negative.

- Scenario modeling to test how changes in volume or behavior affect gross margin.

With this clarity, even pricing conversations become more strategic. You may not raise prices, but you may adjust packaging or terms to protect profitability.

6. Eliminating Internal Friction

Organizations bleed margins through internal friction due to manual processes, approval delays, redundant tools, and a lack of integration.

A CFO looking to expand margin without raising prices should conduct an internal friction audit:

- Where are we spending time, not just money?

- Which tools overlap?

- Which processes create avoidable delays or rework?

Every hour saved in collections, procurement approvals, and financial close contributes to margin by freeing up capacity and accelerating throughput. These gains are invisible to customers but visible on the profit and loss (P&L) statement.

7. Precision Budgeting and Cost Discipline

Finally, no discussion of margin is complete without cost control. But this is not about blanket cuts. It is about precision: the art and science of knowing which costs are truly variable, which drive ROI, and which can be deferred or restructured.

The CFO must move budgeting from a fixed annual ritual to a living process:

- Use rolling forecasts that adjust with real-time data.

- Tie spend approvals to milestone achievement, not just time.

- Benchmark cost centers against peers or past performance with clarity.

In this way, costs become not just something to report—but something to shape.

The Best Margin Is Invisible to the Customer

When you raise prices, customers notice. Sometimes they pay more. Sometimes they churn. However, when you achieve margin through operational excellence, behavioral discipline, and data-driven decisions, the customer remains none the wiser. And your business grows stronger without risking the front door.

This is the subtle, often-overlooked genius of modern financial leadership. Margin expansion is not always about dramatic decisions. It is about understanding where value is created, where it is lost, and how to gently nudge the machine toward higher efficiency, higher yield, and higher resilience.

Before calling a pricing meeting, consider holding a discovery session. Pull your data. Map your unit economics. Audit your funnel. Examine your cost structure. Trace your customer journey. Somewhere, there is a margin waiting to be found.

And it might just be the most profitable thing you do this year without changing a single price tag.

Transforming CFO Roles into Internal Venture Capitalists

I learned early in my career that capital is more than balance and flow. It is the spark that can ignite ambition or smother possibility. During my graduate studies in finance and accounting, I treated projects as linear investments with predictable returns. Yet, across decades in global operating and FP&A roles, I came to see that business is not linear. It progresses in phases, through experiments, serendipity, and choices that either accelerate or stall momentum. Along the way, I turned to literature that shaped my worldview. I grew familiar with Geoffrey West’s Scale, which taught me to see companies as complex adaptive systems. I devoured “The Balanced Scorecard ” and “Measure What Matters,” which helped me integrate strategy with execution. I studied Hayek, Mises, and Keynes, and found in their words the tension between freedom and structure that constantly shapes business decisions. In my recent academic detour into data analytics at Georgia Tech, I discovered the tools I needed to model ambiguity in a world where uncertainty is the norm.

This rich intellectual fabric informs my belief that finance must behave like an internal venture capitalist. The traditional role of the CFO often resembled a gatekeeper. We controlled capital, enforced discipline, and ensured compliance. But compliance alone does not drive growth. It manages risk. What the modern CFO must offer is structured exploration. We must fund bets, define guardrails, measure outcomes, and redeploy capital against the most successful experiments. And just as external investors sunset underperforming ventures, internal finance must have the courage to pull the plug on underwhelming initiatives, not as punishment, but as deliberate reallocation of attention and energy.

The internal-VC mindset positions finance at the intersection of strategy, data, and execution. It is not about checklists. It is about pattern recognition. It is not about spreadsheets. It is about framing. And it is not about silence. It is about active dialogue with product owners, marketers, sales leaders, analysts, engineers, and legal counsel. To be an internal venture capitalist requires two shifts. One is cognitive. We must see every budget allocation as a discrete business experiment with its own risk profile and value potential. The second shift is cultural. We must build circuits of accountability, learning, and decision velocity that match our capital cadence.

My journey toward this philosophy began when I realized that capital allocations in corporate settings often followed the path of least resistance. Teams that worked well together or those that asked loudly received priority. Others faded until the next planning cycle. That approach may work in stable environments. It fails gloriously in high-velocity, venture-backed companies. In those settings, experimentation must be systematic, not happenstance.

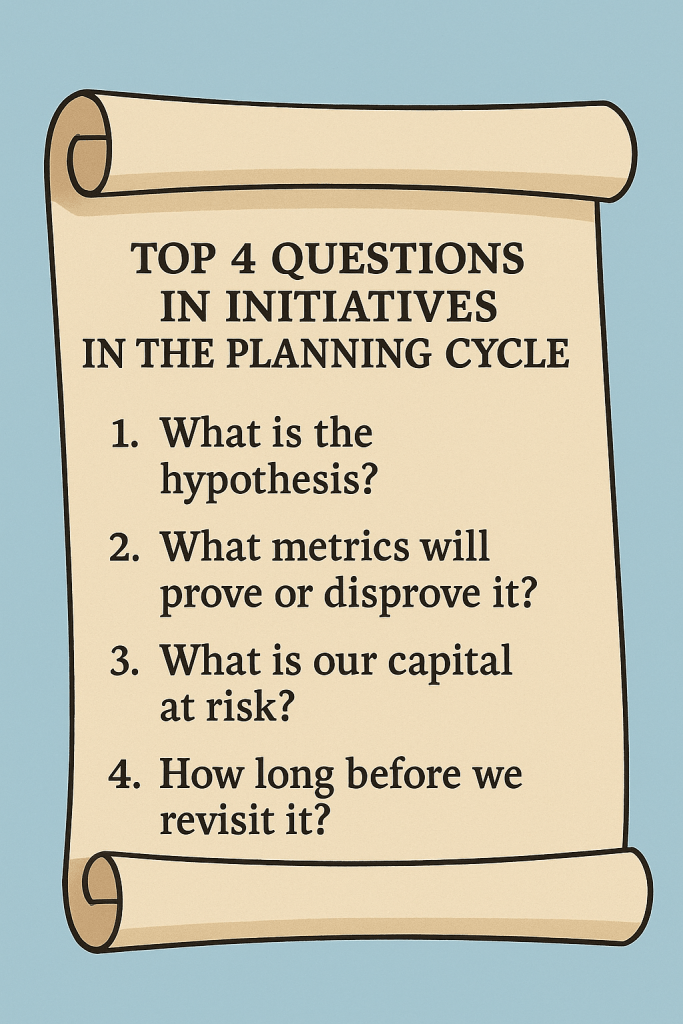

So I began building a simple framework with my FP&A teams. Every initiative, whether product expansion, marketing pilot, or infrastructure build, entered the planning process as an experiment.

We asked four questions: What is the hypothesis? What metrics will prove or disprove it? What is our capital at risk? And how long before we revisit it? We mandated a three-month trial period for most efforts. We developed minimal viable KPIs. We built lightweight dashboards that tracked progress. We used SQL and R to analyze early signals. We brought teams in for biweekly check-ins. Experiment status did not remain buried in a spreadsheet. We published it alongside pipeline metrics and cohort retention curves.

This framework aligned closely with ideas I first encountered in The Execution Premium. Strategy must connect to measurement. Measurement must connect to resource decisions. In external venture capital, the concept is straightforward: money flows to experiments that deliver results. In internal operations, we often treat capital as a product of the past. That must change. We must fund with intention. We must measure with rigor. We must learn at pace. And when experiments succeed, we scale decisively. When they fail, we reallocate quickly and intelligently.

One internal experiment I recently led involved launching a tiered pricing add-on. The sales team had anecdotal feedback from prospects. The product team wanted space to test. And finance wanted to ensure margin resilience. We framed this as a pilot rather than a formal release. We developed a compact P&L model that simulated the impact on gross margin, NRR sensitivity, and churn risk. We set a two-month runway and tracked usage and customer feedback in near real time. And when early metrics showed that a small segment of customers was willing to pay a premium without increasing churn, we doubled down and fast-tracked the feature build. It scaled within that quarter.

This success came from intentional framing, not luck. It came from seeing capital allocation as orchestration, not allotment. It came from embedding finance deep into decision cycles, not simply reviewing outputs. It came from funding quickly, measuring quickly, and adjusting even faster.

That is what finance as internal VC looks like. It does not rely on permission. It operates with purpose.

Among the books that shaped my thinking over the decades, Scale, The Balanced Scorecard, and Measure What Matters stood out. Scale taught me to look for leverage points in systems rather than single knobs. The Balanced Scorecard reminded me that value is multidimensional. Measure What Matters reinforced the importance of linking purpose with performance. Running experiments internally draws directly from those ideas, weaving systems thinking with strategic clarity and an outcome-oriented approach.

If you lead finance in a Series A, B, or C company, ask yourself whether your capital allocation process behaves like a venture cycle or a budgeting ritual. Do you fund pilots with measurable outcomes? Do you pause bets as easily as you greenlight them? Do you embed finance as an active participant in the design process, or simply as a rubber stamp after launch? If not, you risk becoming the bottleneck, not the catalyst.

As capital flows faster and expectations rise higher for Series A through D companies, finance must evolve from a back-office steward to an active internal investor. I recall leading a capital review where representatives from product, marketing, sales, and finance came together to evaluate eight pilot projects. Rather than default to “fund everything,” we applied simple criteria based on learnings from works like The Lean Startup and Thinking in Bets. We asked: If this fails, what will we learn? If this succeeds, what capabilities will scale? We funded three pilots, deferred two, and sunsetted one. The deferrals were not rejections. They were timely reflections grounded in probability and pragmatism.

That decision process felt unconventional initially. Leaders expect finance to compute budgets, not coach choices. But that shift in mindset unlocked several outcomes in short order. First, teams began designing their proposals around hypotheses rather than hope. Second, they began seeking metric alignment earlier. And third, they showed new respect for finance—and not because we held the purse strings, but because we invested intention and intellect, not just capital.

To sustain that shift, finance must build systems for experimentation. I came to rely on three pillars: capital scoring, cohort ROI tracking, and disciplined sunset discipline. Capital scoring means each initiative is evaluated based on risk, optionality, alignment with strategy, and time horizon. We assign a capital score and publish it alongside the ask. This forces teams to pause. It sparks dialogue.

Cohort ROI tracking means we treat internal initiatives like portfolio lines. We assign a unique identifier to every project and track KPIs by cohort over time. This allowed us to understand not only whether the experiment succeeded, but also which variables: segment, messaging, feature scope, or pricing-driven outcomes. That insight fashions future funding cycles.

Sunset discipline is the hardest. We built expiration triggers into every pitch. We set calendar checkpoints. If the metrics do not indicate forward progress, the initiative is terminated. Without that discipline, capital accumulates, and inertia settles. With it, capital remains fluid, and ambitious teams learn more quickly.

These operational tools combined culture and structure. They created a rhythm that felt venture-backed and venture-smart, not simply operational. They further closed the distance between finance and innovation.

At one point, the head of product slid into my office. He said, “I feel like we are running experiments at the speed of ideas, not red tape.” That validation meant everything. And it only happened because we chose to fund with parameters, not promote with promises.

But capital is not the sole currency. Information is equal currency. Finance must build metrics infrastructure to support internal VC behavior. We built a “value ledger” that connected capital flows to business outcomes. Each cohort linked capital expenditure to customer acquisition, cost-to-serve, renewal impact, and margin projection. We pulled data from Salesforce, usage logs, and billing systems—sometimes manually at first—into simple, weekly-updated dashboards. This visual proximity reduced friction. Task owners saw the impact of decisions across time, not just in retrospective QBRs.

I drew heavily on my analytics training at the Georgia Institute of Technology for this. I used R to run time series on revenue recognition patterns. I used Arena to model multi-cohort burn, headcount scaling, and feature adoption. These tools translated the capital hypothesis into numerical evidence. They didn’t require AI. They needed discipline and a systems perspective.

Embedded alongside metrics, we also built a learning ritual. Every quarter, we held a “portfolio learning day.” All teams presented successes, failures, surprises, and subsequent bets. Engineering leaders shared how deployment pipelines impacted adoption. Customer success directors shared early signs of account expansion. Sales leaders shared win-rate anomalies against cohort tags. Finance hosted, not policed. We shared capital insights, not criticism. Over time, the portfolio day became a highly coveted ritual, serving as a refresher on collective strategy and emergent learning.

The challenge we faced was calibration. Too few experiments meant growth moves slowly. Too many created confusion. We learned to apply portfolio theory: index some bets to the core engine, keep others as optional, and let a few be marginal breakers. Finance segmented investments into Core, Explore, and Disrupt categories and advised on allocation percentages. We didn’t fix the mix. We tracked it. We nudged, not decreed. That alignment created valuation uplift in board conversations where growth credibility is a key metric.

Legal and compliance leaders also gained trust through this process. We created templated pilot agreements that embedded sunset clauses and metrics triggers. We made sunset not an exit, but a transition into new funding or retirement. Legal colleagues appreciated that we reduced contract complexity and trimmed long-duration risk. That cross-functional design meant internal VC behavior did not strain governance, but it strengthened it.

By the time this framework matured at Series D, we no longer needed to refer to it as “internal VC.” It simply became the way we did business. We stopped asking permission. We tested and validated fast. We pulled ahead in execution while maintaining discipline. We did not escape uncertainty. We embraced it. We harnessed it through design.

Modern CFOs must ask themselves hard questions. Is your capital planning a calendar ritual or a feedback system? Do you treat projects as batch allocations or timed experiments? Do you bury failure or surface it as insight? If your answer flags inertia, you need to infuse finance with an internal VC mindset.

This approach also shapes FP&A culture. Analysts move from variance detectives to learning architects. They design evaluation logic, build experiment dashboards, facilitate retrospectives, and coach teams in framing hypotheses. They learn to act more like consultants, guiding experimentation rather than policing spreadsheets. That shift also motivates talent; problem solvers become designers of possibilities.

When I reflect on my intellectual journey, from the Austrian School’s view of market discovery to complexity theory’s paradox of order, I see finance as a creative, connective platform. It is not just about numbers. It is about the narrative woven between them. When the CFO can say “yes, if…” rather than “no,” the organization senses an invitation rather than a restriction. The invitation scales faster than any capital line.

That is the internal VC mission. That is the modern finance mandate. That is where capital becomes catalytic, where experiments drive compound impact, and where the business within the business propels enterprise-scale growth.

The internal VC experiment is ongoing. Even now, I refine the cadence of portfolio days. Even now, I question whether our scoring logic reflects real optionality. Even now, I sense a pattern in data and ask: What are we underfunding for future growth? CFOs who embrace internal VC behavior find themselves living at the liminal point between what is and what could be. That is both exhilarating and essential.

If this journey moves you, reflect on your own capital process. Where can you embed capital scoring, cohort tracking, and sunset discipline? Where can you shift finance from auditor to architect? Where can you help your teams see not just what they are building, but why it matters, how it connects, and what they must learn next?

I invite you to share those reflections with your network and to test one pilot in the next 30 days. Run it with capital allocation as a hypothesis, metrics as feedback, and finance as a partner. That single experiment may open the door to the next stage of your company’s growth.

Precision at Scale: How to Grow Without Drowning in Complexity

In business, as in life, scale is seductive. It promises more of the good things—revenue, reach, relevance. But it also invites something less welcome: complexity. And the thing about complexity is that it doesn’t ask for permission before showing up. It simply arrives, unannounced, and tends to stay longer than you’d like.

As we pursue scale, whether by growing teams, expanding into new markets, or launching adjacent product lines, we must ask a question that seems deceptively simple: how do we know we’re scaling the right way? That question is not just philosophical—it’s deeply economic. The right kind of scale brings leverage. The wrong kind brings entropy.

Now, if I’ve learned anything from years of allocating capital, it is this: returns come not just from growth, but from managing the cost and coordination required to sustain that growth. In fact, the most successful enterprises I’ve seen are not the ones that scaled fastest. They’re the ones that scaled precisely. So, let’s get into how one can scale thoughtfully, without overinvesting in capacity, and how to tell when the system you’ve built is either flourishing or faltering.

To begin, one must understand that scale and complexity do not rise in parallel; complexity has a nasty habit of accelerating. A company with two teams might have a handful of communication lines. Add a third team, and you don’t just add more conversations—you add relationships between every new and existing piece. In engineering terms, it’s a combinatorial explosion. In business terms, it’s meetings, misalignment, and missed expectations.

Cities provide a useful analogy. When they grow in population, certain efficiencies appear. Infrastructure per person often decreases, creating cost advantages. But cities also face nonlinear rises in crime, traffic, and disease—all manifestations of unmanaged complexity. The same is true in organizations. The system pays a tax for every additional node, whether that’s a service, a process, or a person. That tax is complexity, and it compounds.

Knowing this, we must invest in capacity like we would invest in capital markets—with restraint and foresight. Most failures in capacity planning stem from either a lack of preparation or an excess of confidence. The goal is to invest not when systems are already breaking, but just before the cracks form. And crucially, to invest no more than necessary to avoid those cracks.

Now, how do we avoid overshooting? I’ve found that the best approach is to treat capacity like runway. You want enough of it to support takeoff, but not so much that you’ve spent your fuel on unused pavement. We achieve this by investing in increments, triggered by observable thresholds. These thresholds should be quantitative and predictive—not merely anecdotal. If your servers are running at 85 percent utilization across sustained peak windows, that might justify additional infrastructure. If your engineering lead time starts rising despite team growth, it suggests friction has entered the system. Either way, what you’re watching for is not growth alone, but whether the system continues to behave elegantly under that growth.

Elegance matters. Systems that age well are modular, not monolithic. In software, this might mean microservices that scale independently. In operations, it might mean regional pods that carry their own load, instead of relying on a centralized command. Modular systems permit what I call “selective scaling”—adding capacity where needed, without inflating everything else. It’s like building a house where you can add another bedroom without having to reinforce the foundation. That kind of flexibility is worth gold.

Of course, any good decision needs a reliable forecast behind it. But forecasting is not about nailing the future to a decimal point. It is about bounding uncertainty. When evaluating whether to scale, I prefer forecasts that offer a range—base, best, and worst-case scenarios—and then tie investment decisions to the 75th percentile of demand. This ensures you’re covering plausible upside without betting on the moon.

Let’s not forget, however, that systems are only as good as the signals they emit. I’m wary of organizations that rely solely on lagging indicators like revenue or margin. These are important, but they are often the last to move. Leading indicators—cycle time, error rates, customer friction, engineer throughput—tell you much sooner whether your system is straining. In fact, I would argue that latency, broadly defined, is one of the clearest signs of stress. Latency in delivery. Latency in decisions. Latency in feedback. These are the early whispers before systems start to crack.

To measure whether we’re making good decisions, we need to ask not just if outcomes are improving, but if the effort to achieve them is becoming more predictable. Systems with high variability are harder to scale because they demand constant oversight. That’s a recipe for executive burnout and organizational drift. On the other hand, systems that produce consistent results with declining variance signal that the business is not just growing—it’s maturing.

Still, even the best forecasts and the finest metrics won’t help if you lack the discipline to say no. I’ve often told my teams that the most underrated skill in growth is the ability to stop. Stopping doesn’t mean failure; it means the wisdom to avoid doubling down when the signals aren’t there. This is where board oversight matters. Just as we wouldn’t pour more capital into an underperforming asset without a turn-around plan, we shouldn’t scale systems that aren’t showing clear returns.

So when do we stop? There are a few flags I look for. The first is what I call capacity waste—resources allocated but underused, like a datacenter running at 20 percent utilization, or a support team waiting for tickets that never come. That’s not readiness. That’s idle cost. The second flag is declining quality. If error rates, customer complaints, or rework spike following a scale-up, then your complexity is outpacing your coordination. Third, I pay attention to cognitive load. When decision-making becomes a game of email chains and meeting marathons, it’s time to question whether you’ve created a machine that’s too complicated to steer.

There’s also the budget creep test. If your capacity spending increases by more than 10 percent quarter over quarter without corresponding growth in throughput, you’re not scaling—you’re inflating. And in inflation, as in business, value gets diluted.

One way to guard against this is by treating architectural reserves like financial ones. You wouldn’t deploy your full cash reserve just because an opportunity looks interesting. You’d wait for evidence. Similarly, system buffers should be sized relative to forecast volatility, not organizational ambition. A modest buffer is prudent. An oversized one is expensive insurance.

Some companies fall into the trap of building for the market they hope to serve, not the one they actually have. They build as if the future were guaranteed. But the future rarely offers such certainty. A better strategy is to let the market pull capacity from you. When customers stretch your systems, then you invest. Not because it’s a bet, but because it’s a reaction to real demand.

There’s a final point worth making here. Scaling decisions are not one-time events. They are sequences of bets, each informed by updated evidence. You must remain agile enough to revise the plan. Quarterly evaluations, architectural reviews, and scenario testing are the boardroom equivalent of course correction. Just as pilots adjust mid-flight, companies must recalibrate as assumptions evolve.

To bring this down to earth, let me share a brief story. A fintech platform I advised once found itself growing at 80 percent quarter over quarter. Flush with success, they expanded their server infrastructure by 200 percent in a single quarter. For a while, it worked. But then something odd happened. Performance didn’t improve. Latency rose. Error rates jumped. Why? Because they hadn’t scaled the right parts. The orchestration layer, not the compute layer, was the bottleneck. Their added capacity actually increased system complexity without solving the real issue. It took a re-architecture, and six months of disciplined rework, to get things back on track. The lesson: scaling the wrong node is worse than not scaling at all.

In conclusion, scale is not the enemy. But ungoverned scale is. The real challenge is not growth, but precision. Knowing when to add, where to reinforce, and—perhaps most crucially—when to stop. If we build systems with care, monitor them with discipline, and remain intellectually honest about what’s working, we give ourselves the best chance to grow not just bigger, but better.

And that, to borrow a phrase from capital markets, is how you compound wisely.