Building Value in Private Equity: A Story of Growth and Time

The Big Idea

Some people think value is something you find like treasure hidden in a cave. But in private equity, value is not found. It is built. It grows the way cities, trees, or living systems grow—by following simple rules, adapting to change, and using energy wisely.

As Geoffrey West explains in Scale, all living and business systems follow patterns of growth and decay. A private equity investment is no different. It begins with a spark of belief, grows through learning and adjustment, and must fight against the natural pull of entropy which is the quiet slide toward disorder.

Building value is not about being clever once. It is about staying disciplined over time.

1. The Beginning: Choosing with Care

Before an investor buys a company, they face the most challenging question: What will be different because we own it?

In this stage, we do not just look at spreadsheets. We ask questions about people, processes, and potential. We look for “scaling rules”—places where minor improvements can multiply results. A good investor studies the system the way a biologist studies an ecosystem. Every number in the model connects to behavior, incentives, and feedback. You cannot fix what you don’t understand.

As someone who has spent decades in finance and operations, I have learned that the best deals start not with excitement, but with honesty. Ask challenging questions before signing the check. Anything you ignore before buying will hurt you later.

2. The First Hundred Days: From Paper to People

Once the deal closes, the real work begins. The first hundred days are like the early growth phase of a city or an organism which is where rhythm, energy, and culture take shape.

The key is not speed, but sequencing. Move too fast, and the organization breaks. Move too slowly, and energy fades. Early wins matter, but trust matters more.

The plan must be simple enough for everyone to understand. I often remind teams: “If the warehouse manager and the sales lead cannot explain the strategy in one sentence, it is not ready.”

As in complex systems, feedback loops keep things healthy. Weekly check-ins, small data dashboards, and short decision cycles build transparency. Trust is the oxygen of transformation—without it, even good plans suffocate.

3. The Middle Years: Fighting Entropy

Every growing system eventually slows down. In cities, it shows up as traffic jams. In companies, it appears as missed deadlines, tired teams, and too many reports.

This is entropy which is the quiet drift toward disorder. You cannot eliminate it, but you can manage it.

The middle years of a private equity investment test the investor’s patience. It is no longer about ideas; it is about maintenance. Which projects still matter? Which metrics still measure the right things? Which leaders are ready for the next phase?

I have seen this pattern repeatedly: the companies that survive entropy are the ones that stay curious. They ask, “Is this still working?” and “What signal are we missing?” Complexity thinking reminds us—adaptation, not rigidity, creates resilience.

4. The Exit: Leaving Gracefully

Exiting an investment is like a scientist passing their experiment to the next researcher. The goal is not to make it perfect; it is to make it understandable and repeatable.

A great exit story is clear and accurate. It does not hide mistakes; it shows learning. Buyers pay a premium for systems they can trust. That means clean data, steady teams, and a clear narrative of progress.

In my own career, the best exits were not the flashiest; they were the ones where the company kept growing long after we left. That is when you know value was built, not borrowed.

Leaving well is an act of leadership. It requires detachment and pride in what’s been created. The company should no longer depend on you. Like a child leaving home, it should stand on its own.

5. The Bigger Picture: Value as a Living System

When I read Geoffrey West’s work, I saw private equity through a new lens. A company is a living system—it consumes energy (capital), grows through networks (people and information), and produces entropy (waste and drift).

The investor’s job is to keep the system alive long enough for it to evolve into something more substantial. That means designing feedback loops, respecting natural limits, and recognizing that scaling is not just about getting bigger, but it is also about getting smarter.

Complexity Theory teaches that order and chaos are partners. Growth always produces tension. The best investors, like good scientists, don’t try to control every variable. They design simple rules and let self-organization take care of the rest.

Final Thoughts

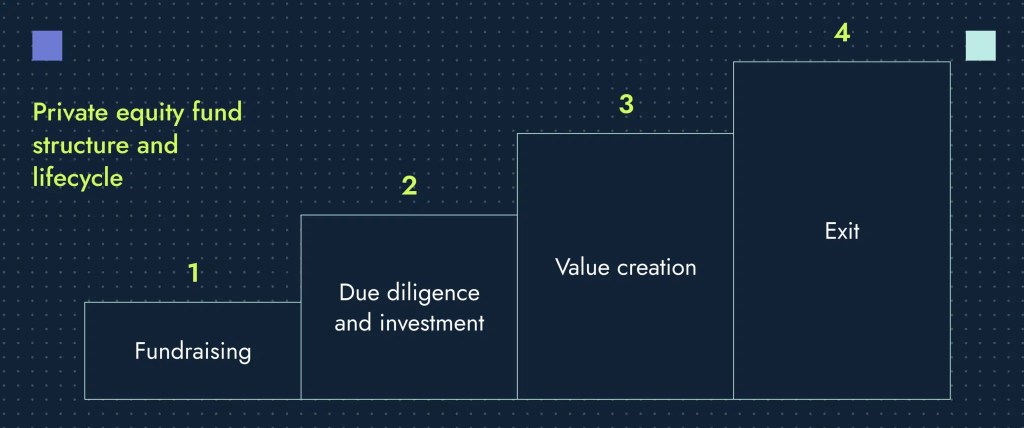

Private equity is really about time—how we use it, manage it, and give it shape. Each phase of the lifecycle tests a different kind of intelligence:

- Imagination at the start

- Discipline in the first hundred days

- Resilience in the middle years

- Clarity at exit

Actual value creation is not about squeezing numbers. It is about building systems that keep learning.

When capital meets curiosity, when plans meet patience, and when leadership meets humility—companies don’t just grow, they evolve.

That is the art of private equity. It is about system building and transformation.

Posted on October 23, 2025, in Employee Engagement. Bookmark the permalink. Comments Off on Building Value in Private Equity: A Story of Growth and Time.