The Power of Customer Lifetime Value in Modern Business

In contemporary business discourse, few metrics carry the strategic weight of Customer Lifetime Value (CLV). CLV and CAC are prime metrics. For modern enterprises navigating an era defined by digital acceleration, subscription economies, and relentless competition, CLV represents a unifying force, uniting finance, marketing, and strategy into a single metric that measures not only transactions but also the value of relationships. Far more than a spreadsheet calculation, CLV crystallizes lifetime revenue, loyalty, referral impact, and long-term financial performance into a quantifiable asset.

This article explores CLV’s origins, its mathematical foundations, its role as a strategic North Star across organizational functions, and the practical systems required to integrate it fully into corporate culture and capital allocation. It also highlights potential pitfalls and ethical implications.

I. CLV as a Cross-Functional Metric

CLV evolved from a simple acknowledgement: not all customers are equally valuable, and many businesses would prosper more by nurturing relationships than chasing clicks. The transition from single-sale tallies to lifetime relationship value gained momentum with the rise of subscription models—telecom plans, SaaS platforms, and membership programs—where the fiscal significance of recurring revenue became unmistakable.

This shift reframed capital deployment and decision-making:

- Marketing no longer seeks volume unquestioningly but targets segments with high long-term value.

- Finance integrates CLV into valuation models and capital allocation frameworks.

- Strategy uses it to guide M&A decisions, pricing stratagems, and product roadmap prioritization.

Because CLV is simultaneously a financial measurement and a customer-centric tool, it builds bridges—translating marketing activation into board-level impact.

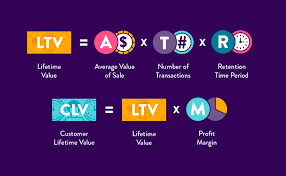

II. How to calculate CLV

At its core, CLV employs economic modeling similar to net present value. A basic formula:

CLV = ∑ (t=0 to T) [(Rt – Ct) / (1 + d)^t]

- Rt = revenue generated at time t

- Ct = cost to serve/acquire at time t

- d = discount rate

- T = time horizon

This anchors CLV in well-accepted financial principles: discounted future cash flows, cost allocation, and multi-period forecasting. It satisfies CFO requirements for rigor and measurability.

However, marketing leaders often expand this to capture:

- Referral value (Rt includes not just direct sales, but influenced purchases)

- Emotional or brand-lift dimensions (e.g., window customers who convert later)

- Upselling, cross-selling, and tiered monetization over time

These expansions refine CLV into a dynamic forecast rather than a static average—one that responds to segmentation and behavioral triggers.

III. CLV as a Board-Level Metric

A. Investment and Capital Prioritization

Traditional capital decisions rely on ROI, return on invested capital (ROIC), and earnings multiples. CLV adds nuance: it gauges not only immediate returns but extended client relationships. This enables an expanded view of capital returns.

For example, a company might shift budget from low-CLV acquisition channels to retention-focused strategies—investing more in on-boarding, product experience, or customer success. These initiatives, once considered costs, now become yield-generating assets.

B. Segment-Based Acquisition

CLV enables precision targeting. A segment that delivers a 6:1 lifetime value-to-acquisition-cost (LTV:CAC) ratio is clearly more valuable than one delivering 2:1. Marketing reallocates spend accordingly, optimizing strategic segmentation and media mix, tuning messaging for high-value cohorts.

Because CLV is quantifiable and forward-looking, it naturally aligns marketing decisions with shareholder-driven metrics.

C. Tiered Pricing and Customer Monetization

CLV is also central to monetization strategy. Churn, upgrade rates, renewal behaviors, and pricing power all can be evaluated through the lens of customer value over time. Versioning, premium tiers, loyalty benefits—all become levers to maximize lifetime value. Finance and strategy teams model these scenarios to identify combinations that yield optimal returns.

D. Strategic Partnerships and M&A

CLV informs deeper decisions about partnerships and mergers. In evaluating a potential platform acquisition, projected contribution to overall CLV may be a decisive factor, especially when combined customer pools or cross-sell ecosystems can amplify lifetime revenue. It embeds customer value insights into due diligence and valuation calculations.

IV. Organizational Integration: A Strategic Imperative

Effective CLV deployment requires more than good analytics—it demands structural clarity and cultural alignment across three key functions.

A. Finance as Architect

Finance teams frame the assumptions—discount rates, cost allocation, margin calibration—and embed CLV into broader financial planning and analysis. Their task: convert behavioral data and modeling into company-wide decision frameworks used in investment reviews, budgeting, and forecasting processes.

B. Marketing as Activation Engine

Marketing owns customer acquisition, retention campaigns, referral programs, and product messaging. Their role is to feed the CLV model with real data: conversion rates, churn, promotion impact, and engagement flows. In doing so, campaigns become precision tools tuned to maximize customer yield rather than volume alone.

C. Strategy as Systems Designer

The strategy team weaves CLV outputs into product roadmaps, pricing strategy, partnership design, and geographic expansion. Using CLV foliated by cohort and channel, strategy leaders can sequence investments to align with long-term margin objectives—such as a five-year CLV-driven revenue mix.

V. Embedding CLV Into Corporate Processes

The following five practices have proven effective at embedding CLV into organizational DNA:

- Executive Dashboards

Incorporate LTV:CAC ratios, cohort retention rates, and segment CLV curves into executive reporting cycles. Tie leadership incentives (e.g., bonuses, compensation targets) to long-term value outcomes. - Cross-Functional CLV Cells

Establish CLV analytics teams staffed by finance, marketing insights, and data engineers. They own CLV modeling, simulation, and distribution across functions. - Monthly CLV Reviews

Monthly orchestration meetings integrate metrics updates, marketing feedback on campaigns, pricing evolution, and retention efforts. Simultaneous adjustment across functions allows dynamic resource allocation. - Capital Allocation Gateways

Projects involving customer-facing decisions—from new products to geographic pullbacks—must include CLV impact assessments in gating criteria. These can also feed into product investment requests and ROI thresholds. - Continuous Learning Loops

CLV models must be updated with actual lifecycle data. Regular recalibration fosters learning from retention behaviors, pricing experiments, churn drivers, and renewal rates—fueling confidence in incremental decision-making.

VI. Caveats and Limitations

CLV, though powerful, is not a cure-all. These caveats merit attention:

- Data Quality: Poorly integrated systems, missing customer identifiers, or inconsistent cohort logic can produce misleading CLV metrics.

- Assumption Risk: Discount rates, churn decay, turnaround behavior—all are model assumptions. Unqualified confidence can mislead investment.

- Narrow Focus: High CLV may chronically favor established segments, leaving growth through new markets or products underserved.

- Over-Targeting Risk: Over-optimizing for short-term yield may harm brand reputation or equity with broader audiences.

Therefore, CLV must be treated with humility—an advanced tool requiring discipline in measurement, calibration, and multi-dimensional insight.

VII. The Influence of Digital Ecosystems

Modern digital ecosystems deliver immense granularity. Every interaction—click, open, referral, session length—is measurable. These dark data provide context for CLV testing, segment behavior, and risk triggers.

However, this scale introduces overfitting risk: spurious correlations may override structural signals. Successful organizations maintain a balance—leveraging high-frequency signals for short-cycle interventions, while retaining medium-term cohort logic for capital allocation and strategic initiatives.

VIII. Ethical and Brand Implications

“CLV”, when viewed through a values lens, also becomes a cultural and ethical marker. Decisions informed by CLV raise questions:

- To what extent should a business monetize a cohort? Is excessive monetization ethical?

- When loyalty programs disproportionately reward high-value customers, does brand equity suffer among moderate spenders?

- When referral bonuses attract opportunists rather than advocates, is brand authenticity compromised?

These considerations demand that CLV strategies incorporate brand and ethical governance, not just financial optimization.

IX. Cross-Functionally Harmonized Governance

A robust operating model to sustain CLV alignment should include:

- Structured Metrics Governance: Common cohort definitions, discount rates, margin allocation, and data timelines maintained under joint sponsorship.

- Integrated Information Architecture: Real-time reporting, defined data lineage (acquisition to LTV), and cross-functional access.

- Quarterly Board Oversight: Board-level dashboards that track digital customer performance and CLV trends as fundamental risk and opportunity signals.

- Ethical Oversight Layer: Cross-functional reviews ensuring CLV-driven decisions don’t undermine customer trust or brand perception.

X. CLV as Strategic Doctrine

When deployed with discipline, CLV becomes more than a metric—it becomes a cultural doctrine. The essential tenets are:

- Time horizon focus: orienting decisions toward lifetime impact rather than short-cycle transactions.

- Cross-functional governance: embedding CLV into finance, marketing, and strategy with shared accountability.

- Continuous recalibration: creating feedback loops that update assumptions and reinforce trust in the metric.

- Ethical stewardship: ensuring customer relationships are respected, brand equity maintained, and monetization balanced.

With that foundation, CLV can guide everything from media budgets and pricing plans to acquisition strategy and market expansion.

Conclusion

In an age where customer relationships define both resilience and revenue, Customer Lifetime Value stands out as an indispensable compass. It unites finance’s need for systematic rigor, marketing’s drive for relevance and engagement, and strategy’s mandate for long-term value creation. When properly modeled, governed, and governed ethically, CLV enables teams to shift from transactional quarterly mindsets to lifetime portfolios—transforming customers into true franchise assets.

For any organization aspiring to mature its performance, CLV is the next frontier. Not just a metric on a dashboard—but a strategic mechanism capable of aligning functions, informing capital allocation, shaping product trajectories, elevating brand meaning, and forging relationships that transcend a single transaction.

Posted on July 17, 2025, in Analytics, Business Process, Financial Metrics. Bookmark the permalink. Comments Off on The Power of Customer Lifetime Value in Modern Business.