CFOs as Venture Capitalists: Rethinking ERP Strategies

Most CFOs view their ERP systems the way civil engineers view bridges—vital, expensive, and terrifying to replace. They are the arteries of the enterprise, moving data and dollars across finance and operations. Yet, despite all the cost and effort, most ERPs underperform their potential.

The reason is not lack of functionality—it is lack of imagination.

After leading multiple ERP transformations—from NetSuite and Sage and BaaN MRP implementations to a global rollout of Oracle Financials integrated with Hyperion and MicroStrategy, I have come to believe that the real return on ERP investment lies not in the code, but in the design philosophy.

It is time CFOs started thinking like venture capitalists and systems engineers.

From Infrastructure to Investment Portfolio

Traditional ERP thinking is defensive: avoid disruption, close the books, ensure compliance. It is the financial equivalent of playing not to lose.

But a venture capitalist asks a different question: where is the next multiple coming from?

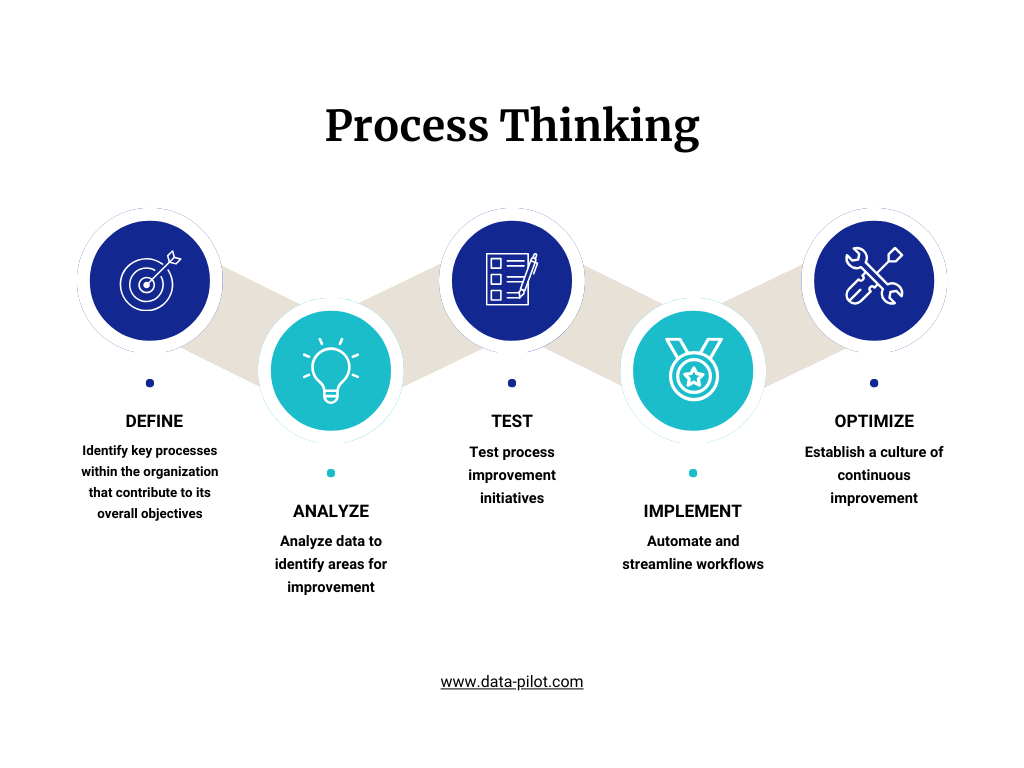

We can treat ERP initiatives the same way—segmenting them into:

- Core Maintenance: compliance, upgrades, and security.

- Leverage Plays: automation, reporting, and workflow redesign.

- Optionality Bets: AI-powered forecasting, agentic automation, and embedded analytics.

This portfolio mindset ensures capital is allocated to where it generates the most operational leverage, not where it merely reduces anxiety.

The Power of Horizontal Thinking

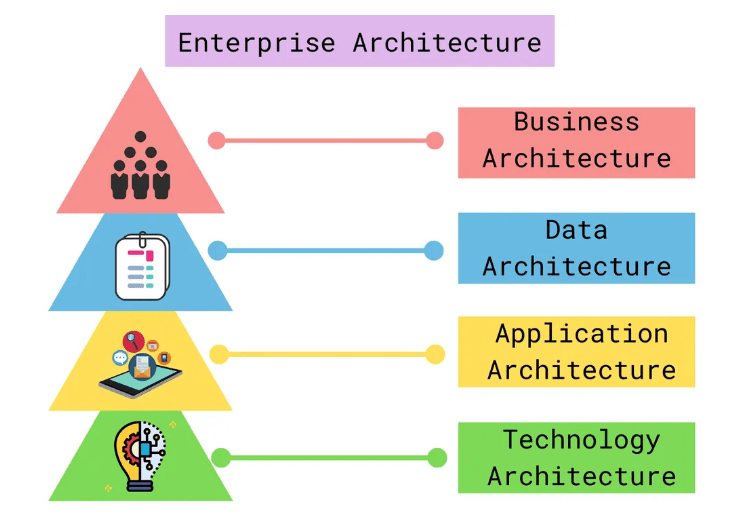

Most ERP failures are not technical – they are architectural. Companies build vertical silos: Finance here, Procurement there, HR in another system. Each one optimized locally but misaligned globally.

The future belongs to horizontal, workstream-focused systems—built around flows like Order-to-Cash, Procure-to-Pay, and Record-to-Report.

Why does this matter? Because workstreams are where value flows. That is where automation compounds, latency disappears, and teams feel the impact of technology.

When I oversaw our Oracle-Hyperion-MicroStrategy global rollout, the biggest unlock did not come from adding modules. It came from aligning processes horizontally—so that planning, consolidation, and analytics spoke the same language. That is when the ERP stopped being a ledger and started being an intelligence engine.

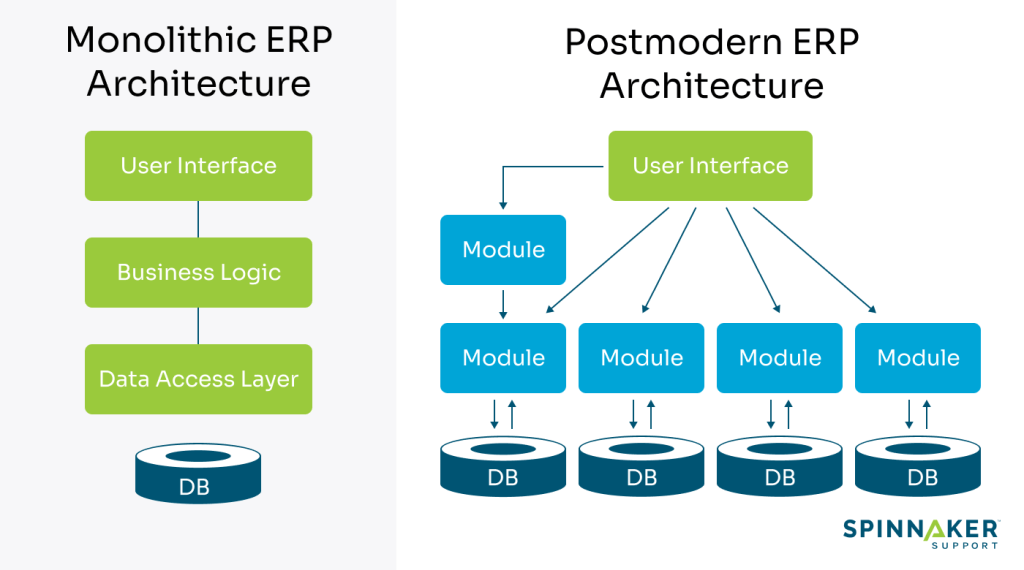

Why Modularity Enables Agentic AI

Horizontal ERPs are, by nature, modular. Each component—finance, procurement, analytics—interacts through clean APIs and governed data layers. This modularity is exactly what Agentic AI systems need to thrive.

AI agents are not magic—they are orchestration tools. They need consistent structures, good metadata, and systems that can “talk” to each other. A modular ERP built on sound governance becomes the perfect substrate for AI copilots that can:

- Reconcile accounts automatically,

- Trigger proactive alerts for anomalies,

- Forecast cash flow in real time, and

- Suggest workflow optimizations based on patterns.

When the ERP is monolithic, AI is decorative. When it is modular, AI becomes multiplicative.

Designing for Hidden ROI

The hidden ROI zones are everywhere once you start looking:

- Process Acceleration – Automating intercompany eliminations or close cycles.

- Data Visibility – Converting stale reports into live dashboards.

- Workflow Integration – Syncing ERP with CRM, HRIS, and procurement to eliminate handoffs.

Each enhancement may look small, but compounded across a finance organization, they can save thousands of hours per year.

That is how venture thinking turns into financial engineering.

Metrics Boards Actually Care About

We do not measure ERP ROI in “go-live” dates anymore. We measure it in:

- Days to close,

- Time to insight,

- Cost per transaction, and

- Productivity per finance FTE.

These are tangible, board-level metrics that link system efficiency directly to enterprise value.

Governance: The Unsung Hero

The best ERPs die slowly—not from bugs, but from bloat. Over-customization, consultant dependence, and poor data hygiene suffocate agility.

Good governance means lean design, modular rollouts, transparent contracts, and internal ownership. It is less glamorous than AI, but without it, innovation becomes entropy.

Final Word: ERP as a Competitive Advantage

ERPs are not going away: they are the spine of the enterprise. But we can make them smarter, faster, and more horizontal.

When designed with modularity, governed with discipline, and infused with agentic intelligence, the ERP evolves from a cost center into a compounding asset.

The CFO who thinks like a venture capitalist and designs like a systems architect will find that the next great ROI story is already sitting inside the general ledger waiting to be unlocked.

Posted on October 24, 2025, in Employee Engagement. Bookmark the permalink. Comments Off on CFOs as Venture Capitalists: Rethinking ERP Strategies.