Convertible Debt: What, How, Plus, Minus?

Convertible Debt is also called convertible loans or convertible notes. This is a common method of financing for early stage companies. Typically, an investor or a group of investors (investor syndicate) extends a loan to a company that could later convert to an equity instrument. Like any debt, it is an interest bearing instrument. However, the key element in this form of financing is that the investors will get equity at a discount when the Company raises a Series A round. In other cases, it could be a warrant issue. In most instances, there is a cap on the valuation at which the debt will convert.

Hence, there are four key components of convertible debt:

- Convertible Debt has an interest.

- Convertible Debt has a discount

- Convertible Debt may have warrants

- Valuation at which Debt converts is capped.

Let us discuss each of these in detail.

Convertible Debt is interest bearing.

Like any debt, the borrower has a loan on their balance sheet. They are responsible for the principal and the interest. The interest is simple interest rate, and there is a fixed due date (or “maturity date”) for repayment of the amount borrowed. In other words, if there is no Series A funding before the maturity of the convertible debt, there could be some problems for the company. In an extreme case, the note holder can force the company into bankruptcy, unless the startup can renegotiate and extend the terms. The appropriate interest rate for convertible debt could be anywhere between 6% up to 10%. The Applicable Federal Rates (AFRs) can establish the lowest legally allowable interest rates.

Convertible Note Discount.

As a sweetener, the note will have an automatic conversion discount feature by which the investor will exchange the convertible debt for shares of a Series A Preferred Stock at a discount to the price per share paid by a VC in a Qualified Financing Round. Here is how this works:

A) Angel invests $100,000 in the startup company.

B) Startup issues the convertible note for $100K which has an interest and maturity date.

C) The Note has an automatic conversion feature at $1M with a conversion discount equal to 20%.

D) Now, let us say that the Startup closes $1M Series A Preferred Stock at $1 per share.

E) The Angel thus gets the shares at 80 cents.

F) So Angel gets $100,000/$0.80 per share of the Series A Preferred which totals to 125,000 shares.

Convertible Notes may have warrants.

The warrants are very similar to options. In a typical convertible note, the Warrant will be an option for whatever security is sold in the next round. It is often expressed in terms of “warrant coverage percentage”. A 20% warrant coverage means that you can take the same $1M, multiply by 20%, and the Warrant independently will enable you to get $200K of additional securities in the next round. For example, let us say a Series A round is $4M (Company has raised $4M). The warrant coverage kicks in and now the size of the round becomes $5.2M. ($4M New Fund + $1M size of Note + $200K warrant coverage = $5.2M) So there is a dilution impact of $1.2M for the $1M of angel cash that was extended in the form of the Note with the Warrant Coverage.

Convertible Notes Caps

Cap is a term that protects the angel investor and puts a ceiling on the conversion price of debt. This is seen mostly in seed financings. For example, angel invests a $100K in a company at 20% discount and thinks that the pre-money valuation maxes out at $3M. If the angel was correct and the valuation was indeed at $3M (assume $1.00 for preferred share) , then the angel would have 125,000 shares. That would be 125,000 shares/(3M shares + 125,000) = 4%. The investor would own 4% immediately upon Qualified Financing.

However, assume that the company is hugely successful and the pre-money valuation is assessed at $10M. Let us say that the preferred stock is at $1.00. So now you have 10M shares. Angel Investor gets 125,000 shares. Then the Investor is diluted down to 1.23%. (125K shares/ (10M shares + 125K shares)). Hence the higher the valuation in Series A, the investor gets diluted down further. Hence they use Convertible Notes Caps as a protection to their downside dilution risk. The cap sets a limit for how much the Company can raise before the investor’s shares stop getting diluted. It sets an upper limit. So if the investor in the above example sets a cap at $5M, then the discount would increase to offset the additional dilution that occurred. So in this case, the investor actually gets a 50% discount, not a 20% discount. It is important to note that the cap is structured as either or – in other words, the angel investor gets the value of the greater of the two discounts.

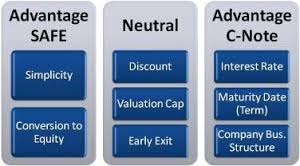

Advantages of Convertible Debt Financing

- Easy to raise

- Paperwork could be less than 10 pages.

- Quick turnaround time to get this signed off

- Terms are generally clearly defined

- Legal Expenses are typically less than $5000-$8000.

- Company can defer the valuation discussion until a later date

- Notes have fewer rights than Equity. Investors in Notes have less say in the direction and execution of company plans.

Disadvantages of Convertible Debt Financing

- It is a loan and there is a maturity date on the loan. If financing does not occur, the investor can recall the note and force the company into bankruptcy.

- Incentives are not necessarily aligned. Company wants more valuation in Series A but investor would want less to own larger pool. With a cap, they accomplish that but the Company owners are diluted down depending on cap or size of discount.

- Size of discount or cap could create problems for the Company seeking Series A. Series A investors might force a renegotiation thus increasing legal and other costs to the Company. A low valuation cap could adversely affect the owners of the Company.

- Conversion to equity would mean equivalent privileges with respect to rights. Bear in mind that angel investors are generally not professional VC’s and each of them have very different expertise. Equivalent rights for the different expertise may create problems and issues among all parties involved.

- Convertible Notes may have senior preferences. In the event of liquidation, the Note Holders are first in line to get their money back.

- Some angel investors may want subscription rights or super pro-rata rights to the next round of funding. This is to prevent their dilution. So they may want to have the option to participate up to a certain percentage of the next round. In other words, if the round is $5M, the subscription right might specify that the investor can participate up to 30% and that would mean that the investor has a bigger seat on the table. Such clauses may not be favorably looked at by Series A investor and these clauses could hold up financing.

Posted on March 16, 2014, in finance, investment, startup and tagged angel investor, convertible notes, debt, dilution, entrepreneur, equity, finance, financing, Series A, startup. Bookmark the permalink. Leave a comment.